New business Advisory

Which type of business entity you choose will impact the way you maintain your records, the expenses that can be deducted and many other tax related implications. At Acura Books our tax consultants are experienced with structuring all entity types to minimize tax liabilities and ease administration.

This is one of the most important decisions you will make for your company and it can have both positive and negative consequences.

Our new business advisor services include:

- Small business start-up consulting

- New business formation assistance

- Selection of the right structure - S-Corporation, C-Corporation, Partnership

- Business plan development

- Bookkeeping and payroll services

- Cash flow projections

Virtual Assistance

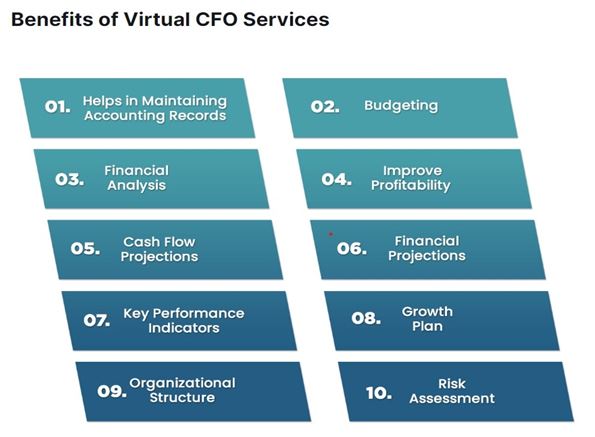

- Collaborate with our diverse client base to offer targeted financial advice, leveraging your prior experience as a CFO in various industries (e.g., IPO, SaaS, Consumer Packaged Goods, etc.).

- Analyze financial data, identify trends, and present actionable insights to help clients make informed decisions.

- Provide guidance on financial planning, budgeting, and forecasting strategies to support clients' growth goals.

- Assist in optimizing financial operations, including improving cash flow, managing costs, and enhancing financial controls.

- Contribute to the development of financial models, performance metrics, and key performance indicators (KPIs).

- Collaborate with cross-functional teams to offer well-rounded business solutions to clients.

Business and Financial Consulting Services

In the life of every small business there's a point when you're ready to head to the next level, but aren't sure how to get there. At Acura Books we can show you how to put your business on the path to growth, expansion, and higher profits.

As a business consultant and Acura Books has the financial expertise your business needs to succeed. Our goal is to increase your bottom line by eliminating unnecessary costs, carefully tracking assets and expenses, and developing a strategy to decrease tax liability. We'll find ways to simplify accounting procedures so you can stay organized and tighten up internal controls. We'll also deliver detailed financial reports so you can keep a close eye on where your money is going. Most importantly, when you work with us, we'll become your trusted business advisor. We'll make ourselves available to answer questions or discuss any major business decisions that could impact your finances.